NAHB Education is offering a variety of dynamic webinars for housing industry professionals every Wednesday in July. These webinars are structured to help participants expand their knowledge about industry best practices in customer service, design, and sales and marketing. Many are offered at a discount to NAHB members, including several that are free for certain council members.

Be sure to reserve your spot today! If you are unable to attend, you will get access to the webinar replay for 12 months.

Check out the schedule for July:

Update Your Elevations: A Live Demo on Applying Multiple Facades to a Single Floor Plan

Wednesday, July 15

1-2 p.m. ET

Learn how to create multiple unique elevations ranging from traditional to contemporary in a live 3D modeling demonstration. Walk away with the knowledge to offer your clients a variety of options and the choices they desire. Register now.

Evergreen Online Lead Conversion: Creating a Strategy That’s Ready for the Unexpected

Wednesday, July 22

2-3 p.m. ET

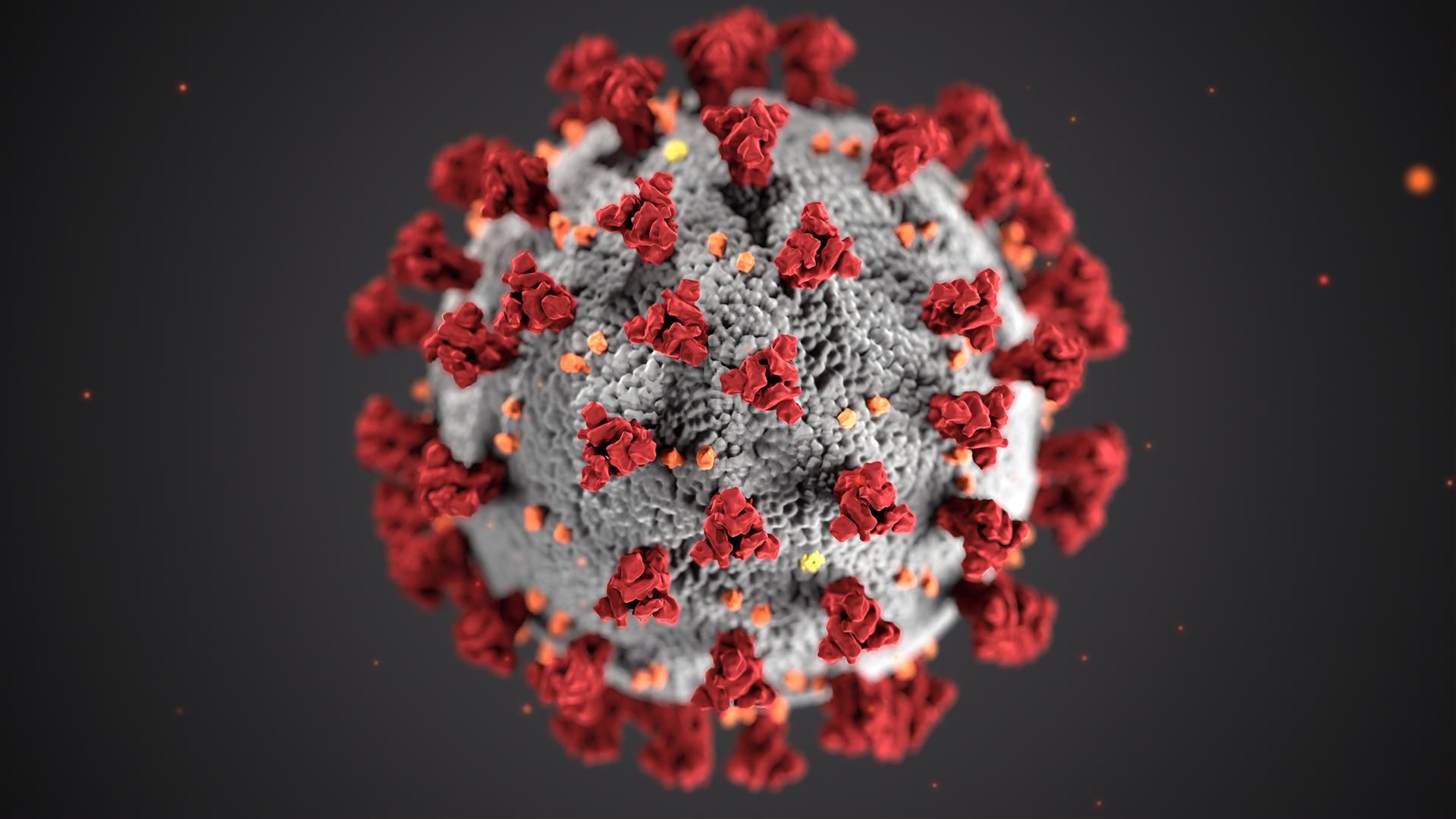

Build a successful digital marketing engine that converts online leads and boosts sales in the unpredictable markets where you operate. With the impact of COVID-19 still looming, you’ll learn what it takes to navigate change and create a business pipeline that’s not just immune to disruption, but actually designed for it. Free for NAHB’s National Sales & Marketing Council members. Register now.

New Rules for Creating an Exceptional Customer Experience

Wednesday, July 29

2-3 p.m. ET

Discover the biggest pain points for home buyers and how your team can provide “WOW” moments to ensure high levels of customer satisfaction and the end-to-end experience buyers want. Register now.

Register today. For questions about registration, please contact Deborah Krat at EdWebinars@nahb.org.